Financial News vs. Noise Newsletter

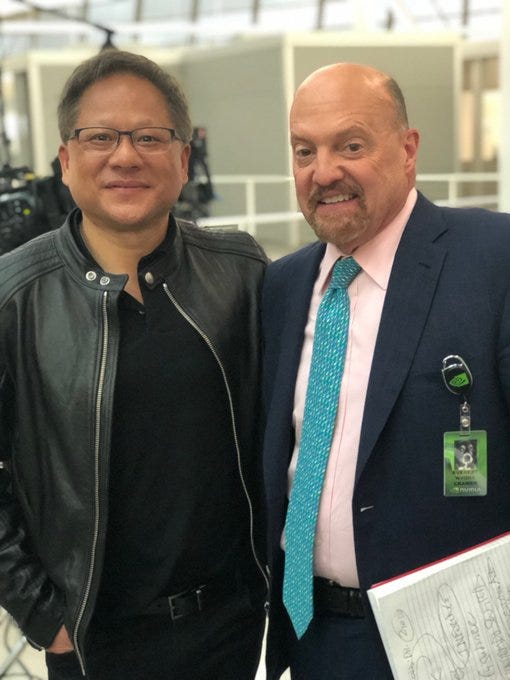

Credit where it’s due on NVDA, Cramer has been on this one for a long time and he has been right.

NVDA single-handedly led to the demise of SJIM, but our second biggest ETF is 2x long NVDA (NVDX) so I certainly cant complain. Interestingly we saw small outflows yesterday with the biggest inflow day ever into NVDQ (2x short NVDA)

Tweets

Be aware that there are people today who do not care how much they pay to buy SQ, it's a pathetic lapdog group of buyers who will chase it.....

AVGO

ABNB

KO

PGE

BLDR

WING

TSM

DHR

TSN

WDAY

NOW

CRM

VRT

PSTG

ARM

RIVN

GFS

CALM

The views and opinions expressed herein are those of the Chief Executive Officer and Portfolio Manager for Tuttle Capital Management (TCM) and are subject to change without notice. The data and information provided is derived from sources deemed to be reliable but we cannot guarantee its accuracy. Investing in securities is subject to risk including the possible loss of principal. Trade notifications are for informational purposes only. TCM offers fully transparent ETFs and provides trade information for all actively managed ETFs. TCM's statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. Trade notification files are not provided until full trade execution at the end of a trading day. The time stamp of the email is the time of file upload and not necessarily the exact time of the trades.

TCM is not a commodity trading advisor and content provided regarding commodity interests is for informational purposes only and should not be construed as a recommendation. Investment recommendations for any securities or product may be made only after a comprehensive suitability review of the investor’s financial situation.

© 2024 Tuttle Capital Management, LLC (TCM). TCM is a SEC-Registered Investment Adviser. All rights reserved.